Jan 8, 2025

Bitcoin price prediction: They will do UNTHINKABLE in 24 hours

Bitcoin is on the move, and right now, it's essential to understand the dynamics of the market. In this blog, we will dive deep into the current situation, analyzing key indicators, market trends, and what this means for Bitcoin's future. If you're looking for Bitcoin price prediction and insights into BTC technical analysis today, you've come to the right place.

Understanding Market Signals

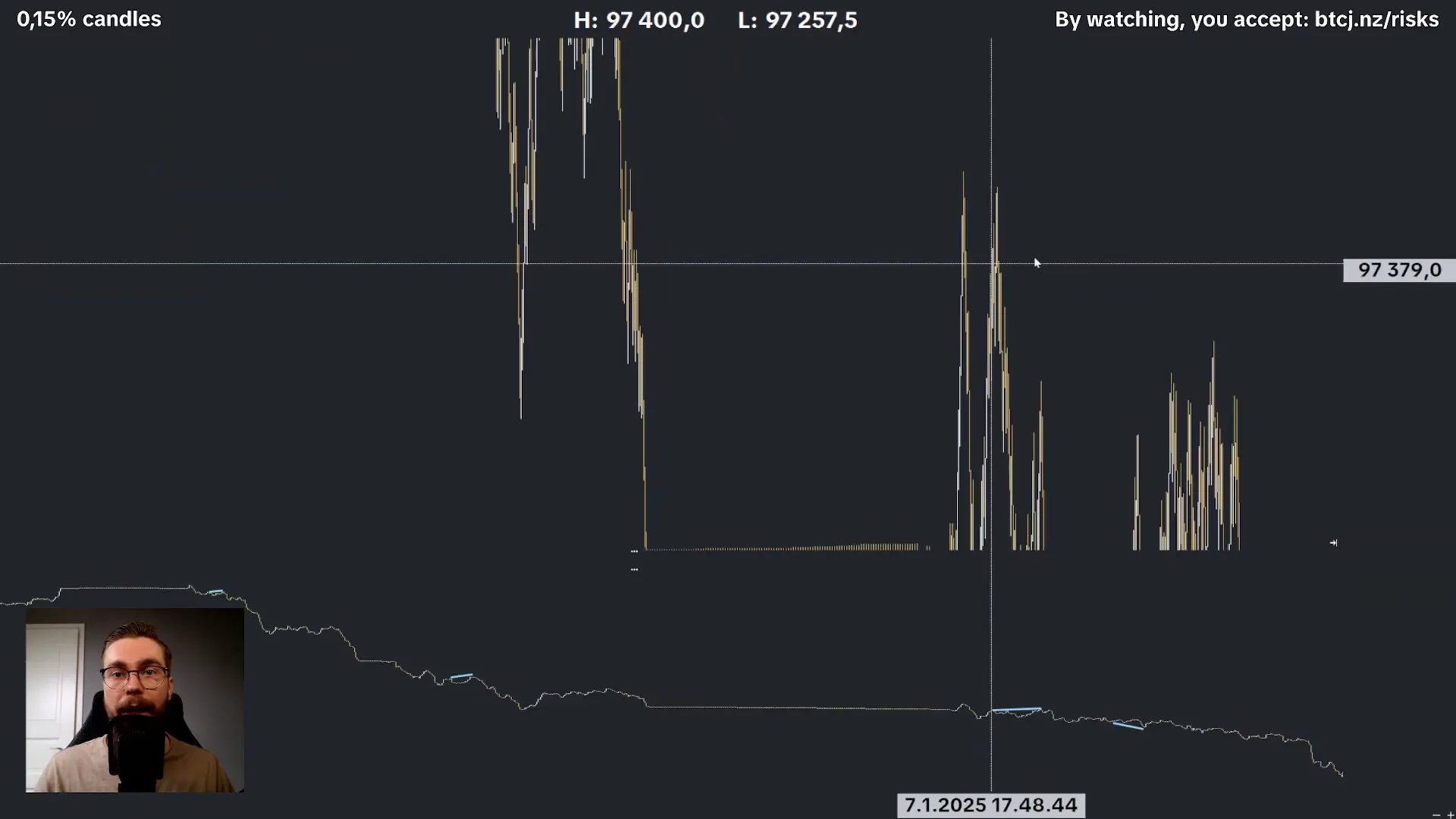

The first warning signal appeared when Bitcoin couldn't break a high while the market sell volume increased.

This is a clear indicator of what’s happening in the market. The next signal came when Bitcoin was unable to break the 98,800 mark, with the market buy volume rising again.

This pattern repeated itself at the 97,500 mark, where retail investors bought, but market makers sold.

So, what does this mean? It’s simple: when market sales increase and Bitcoin fails to hit new highs, it suggests a bearish trend. The mid-term market structure break higher indicates that while Bitcoin's trend remains positive, there were warning signs yesterday.

Current Market Conditions

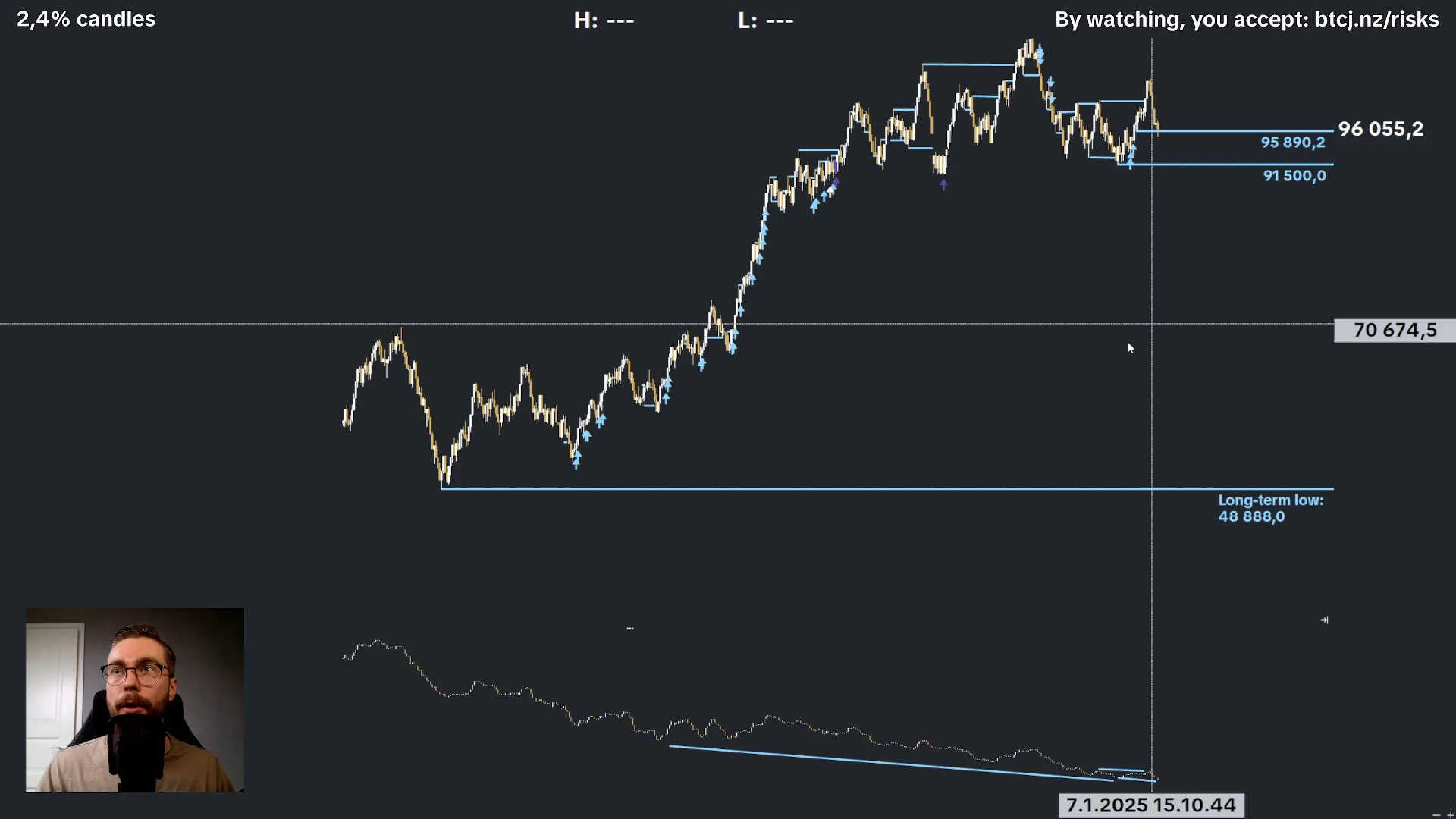

As of now, the long-term low is under 48,900. As long as this level holds, Bitcoin's long-term bull market will continue. Also, we are seeing an increase in market sell volume, meaning retail investors are getting liquidated more than they did around the 60,000 mark.

In the big picture, if Bitcoin's midterm trend continues to rise above all-time highs, the 91,500 level could serve as a higher long-term low. If this level breaks after that, it could signal a downturn.

Key Support Levels

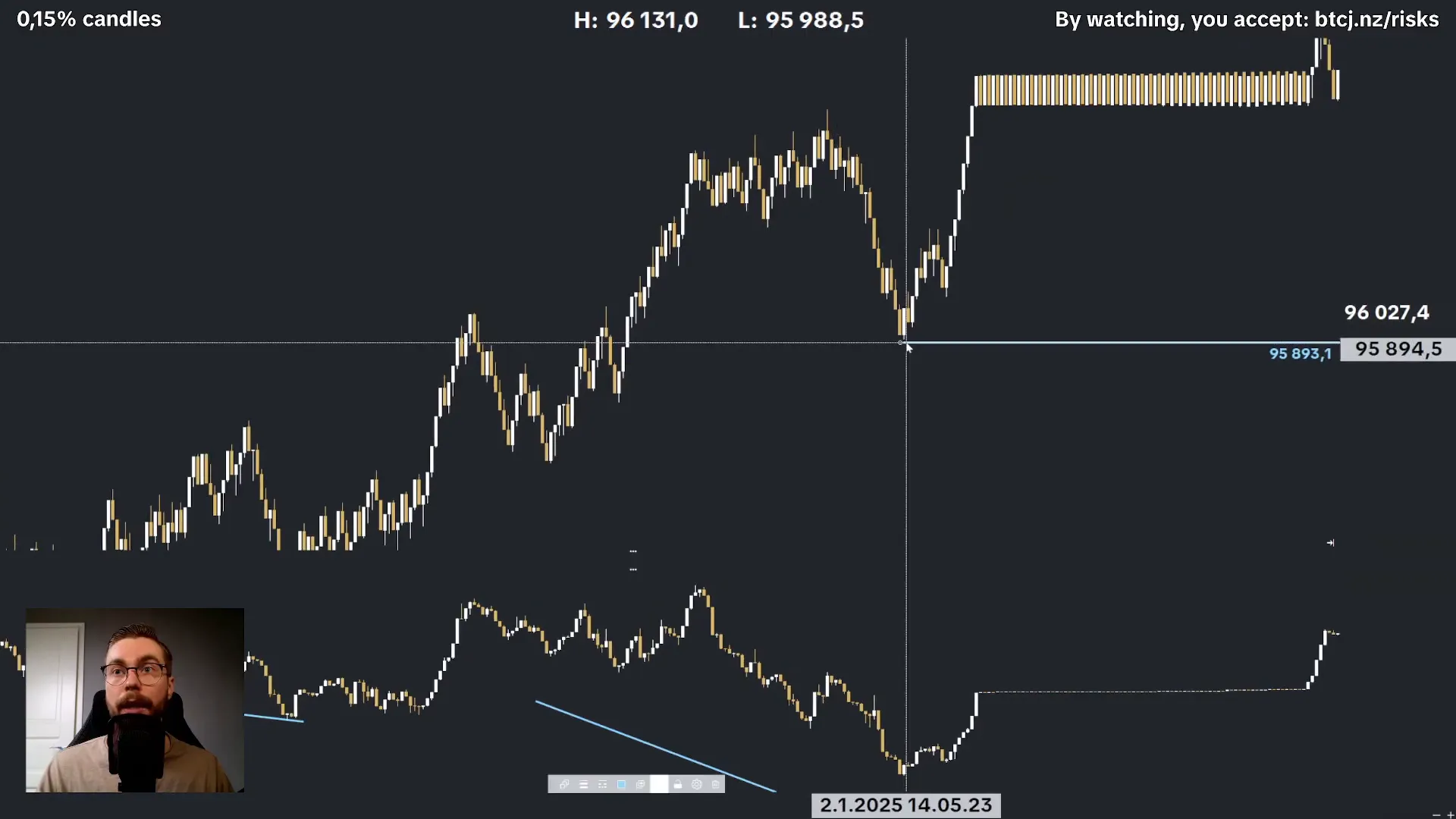

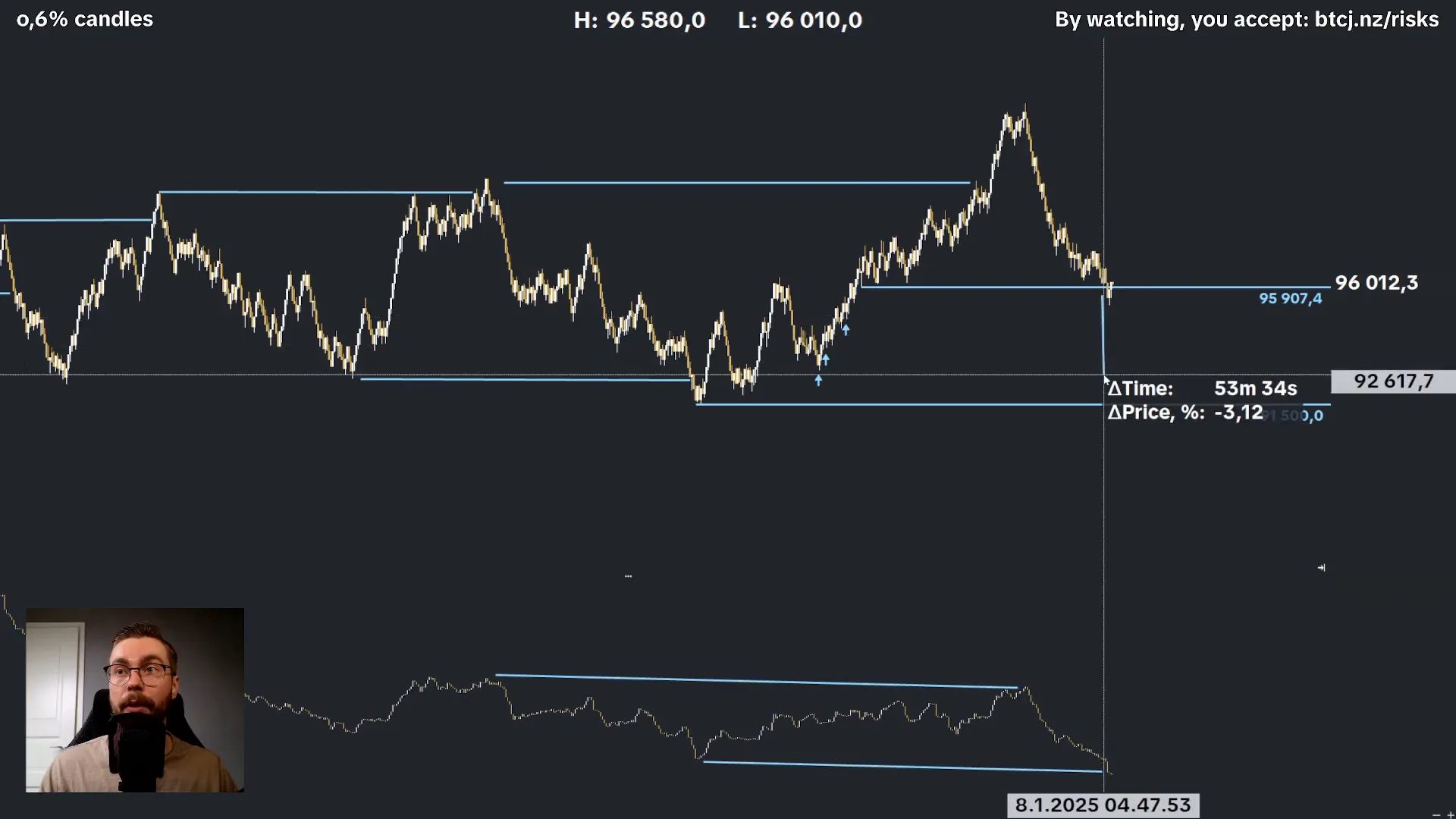

Currently, we are at an important level of 95,900. This is crucial because market makers and retail investors did opposite decisions there.

These divergences are key levels to watch. Other significant levels include 94,800 and 91,500. Each of these levels shows divergence.

These levels need to be monitored closely as they indicate where market makers might step in to buy while retail investors are forced to sell.

Trading Strategy

Given the current situation, I am willing to take long trades even if Bitcoin drops below 91,500. The market dynamics suggest that if retail investors are being liquidated while prices rise, it’s a sign that market makers are taking advantage of the situation.

TIP: It's crucial to understand that market makers have massive capital. For instance, if a market maker has 500 million dollars to spend, they will need retail investors to sell for them to buy. This creates a unique opportunity for those who are aware of the market's inner workings.

Conclusion

With the BTC price prediction showing strong indicators for potential growth, it's essential to keep an eye on market trends. As long as key support levels hold and market dynamics favor long trades, there could be significant opportunities ahead.

FAQ

What are the key indicators to watch for Bitcoin price predictions?

Key indicators include market buy & sell volume, support levels, and divergences between market orders and price action.

Is it a good time to invest in Bitcoin?

It depends on your risk tolerance and market conditions. Monitor the key support levels and market dynamics for better insights.

Where can I find more information about Bitcoin trading strategies?

You can follow Bitcoin Joonas on YouTube for daily updates and trading strategies.

Also, don't forget to claim your bonuses for trading on platforms like Kucoin: Instant $200 bonus through this link and Bybit: Free $500 trade though this link to enhance your trading experience!

This content is strictly for educational and entertainment purposes only. It is not financial advice. I am not a financial advisor. All links in this blog are affiliate links; I may receive compensation if you use them. Read more in the full disclaimer.